EA vs CPA: Key Differences Explained

Compare Enrolled Agent vs CPA: licensing, exams, education, career paths, and salaries to help decide between tax specialization or broader accounting roles.

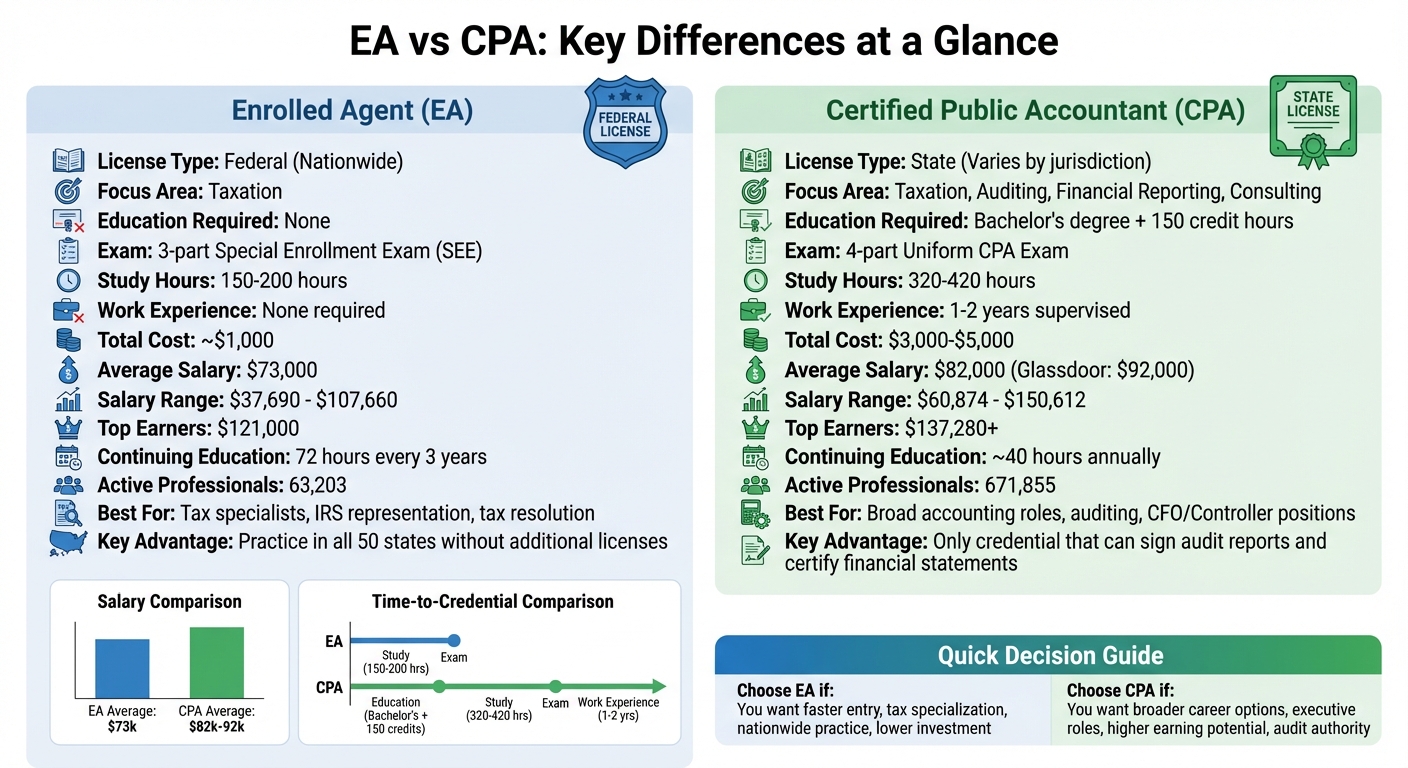

Deciding between becoming an Enrolled Agent (EA) or a Certified Public Accountant (CPA) depends on your career goals in taxation and accounting. Here’s a quick breakdown:

- EAs are federally licensed tax experts focusing on IRS matters like tax preparation, audits, and appeals. They require no degree, just passing a three-part tax exam. EAs can work in all 50 states without additional licenses. Average salary: $73,000.

- CPAs are state-licensed professionals with a broader scope, including auditing, financial reporting, and business consulting. Becoming a CPA requires a bachelor’s degree, 150 credit hours, supervised work experience, and passing a four-part exam. CPAs typically earn more, with an average salary of $82,000.

The choice boils down to specialization vs. versatility. EAs excel in tax-related roles, while CPAs offer wider career opportunities in finance and accounting.

Quick Comparison

| Criteria | Enrolled Agent (EA) | Certified Public Accountant (CPA) |

|---|---|---|

| License Type | Federal (Nationwide) | State (Varies by jurisdiction) |

| Focus Area | Taxation | Taxation, Auditing, Financial Reporting |

| Education Required | None | Bachelor’s + 150 credit hours |

| Exam | 3-part Special Enrollment Exam (SEE) | 4-part Uniform CPA Exam |

| Work Experience | None | 1–2 years supervised |

| Average Salary | $73,000 | $82,000 |

| Continuing Education | 72 hours every 3 years | ~40 hours annually |

| Best For | Tax specialists, IRS representation | Broad accounting and finance roles |

Both paths offer strong career potential. Choose EA for a quicker start in taxation or CPA for broader financial expertise. If you're ready to transition into one of these roles, you can land jobs faster with professional application support.

EA vs CPA Comparison: Requirements, Salary, and Career Paths

What Is an Enrolled Agent (EA)?

EA Definition and Authority

An Enrolled Agent (EA) is a federally licensed tax professional, authorized by the U.S. Treasury to represent any taxpayer in dealings with the IRS. Unlike CPAs or attorneys, who are licensed by individual state boards, EAs hold a federal credential that allows them to operate in all 50 states without restrictions.

"Enrolled agents are the only tax professionals who do not require a state license. However, they have a federal license and can represent a taxpayer in any state." - National Association of Enrolled Agents

EAs have broad authority to represent individuals, corporations, partnerships, trusts, and estates in IRS matters. This includes audits, collections, appeals, and even complex negotiations like penalty abatements or offer-in-compromise agreements. Currently, there are 63,203 active Enrolled Agents in the U.S., a relatively small group compared to the 671,855 CPAs.

The profession has roots dating back to 1884, when Congress created it to address Civil War-related claims. Today, the IRS considers the EA designation its highest credential, granting EAs the same rights as CPAs and attorneys in representing clients before the agency.

This federally backed credential ensures a straightforward certification process for aspiring EAs.

How to Become an EA

Becoming an EA is a more accessible path compared to earning a CPA license. There’s no formal degree requirement - no need for a bachelor’s degree or 150 credit hours. Here’s how the process works:

- Obtain a Preparer Tax Identification Number (PTIN) from the IRS.

- Pass the Special Enrollment Examination (SEE), which consists of three parts:

- Part 1: Individual taxation

- Part 2: Business taxation

- Part 3: Representation, Practices, and Procedures

Each part includes 100 questions, takes 3.5 hours, and requires a scaled score of 105 to pass. The parts can be taken in any order, and passing scores remain valid for three years.

The SEE is available from May 1 through February’s end each year (it’s closed in March and April for tax law updates). The total exam fee is $801, and most candidates spend 150–200 hours preparing.

- After passing, submit Form 23 to apply for enrollment within one year. The IRS conducts a suitability review, which includes checking tax compliance and criminal history. Former IRS employees with at least five years of relevant technical tax experience can skip the exam and apply directly for EA status.

- Once enrolled, maintain the credential by completing 72 hours of continuing education every three years (at least 16 hours annually, including two hours of ethics). The initial enrollment application fee is $140.

EA Job Responsibilities and Career Options

With their credentials, EAs often specialize in tax resolution and advisory services.

Their primary responsibilities include preparing tax returns for individuals and businesses, creating tax planning strategies, and representing clients during IRS disputes. EAs handle everything from routine audits to complex appeals and collections cases.

"EAs command premium rates for specialized tax resolution work while CPAs dominate corporate finance roles." - CEO, Complete Controller

The average annual salary for EAs is about $73,000, with earnings ranging from $37,690 to $107,660, according to the U.S. Bureau of Labor Statistics. Full-time EAs with 4–7 years of experience typically make between $50,000 and $70,000 per year, while top earners can reach $121,000 annually. Those specializing in tax resolution and IRS representation often charge hourly rates of $100 to $400.

One major advantage of the EA credential is its federal scope, allowing EAs to serve clients in any state without additional licensing. This flexibility is especially valuable in today’s remote work environment. To navigate this competitive landscape, many professionals transform their job search with a virtual assistant to manage applications and outreach. Career opportunities include working for tax preparation firms, starting independent practices, joining tax resolution companies, or consulting. While the demand for tax examiners is projected to decline by 4% from 2020 to 2030, this may lead to greater reliance on private EAs for complex tax disputes.

What Is a Certified Public Accountant (CPA)?

CPA Definition and Authority

A Certified Public Accountant (CPA) is a state-licensed professional specializing in accounting, auditing, and financial reporting. CPAs earn their licenses from state boards of accountancy and typically work in areas like auditing, business valuation, financial reporting, and strategic financial management.

What sets CPAs apart is their exclusive authority to sign audit reports and certify financial statements. This role is crucial for publicly traded companies, businesses seeking loans, and organizations that need audited financial statements for shareholders or regulatory agencies like the SEC.

"Only a CPA can address a case or scenario with broader financial scope, such as auditing financial statements for the shareholders or reporting information to the SEC." - Shannon Cantor, Content Marketing Specialist, Becker

Unlike Enrolled Agents (EAs), who hold a federal license, CPAs are generally limited to practicing in the state where they are licensed. This state-specific authority underscores their unique qualifications in auditing and financial reporting.

How to Become a CPA

Becoming a CPA involves meeting demanding academic, exam, and experience requirements. Most states require 150 semester hours of education, typically achieved through a bachelor’s degree plus additional coursework or a master’s program. Candidates must also pass the Uniform CPA Examination, which consists of four sections: three core areas (Financial Accounting and Reporting, Auditing and Attestation, and Regulation) and one discipline section chosen from three options. The exam takes about 16 hours to complete, and candidates usually dedicate 320 to 420 hours to study for it. All four sections must be passed within an 18-month rolling period.

In addition to passing the exam, most states require CPA candidates to gain one to two years of full-time professional experience under the supervision of a licensed CPA. After earning their license, CPAs must complete Continuing Professional Education (CPE) annually - typically averaging 40 hours per year - to maintain their credentials.

"CPAs have a broader knowledge base in all facets of accounting while EAs only focus on tax." - Shannon Cantor, Content Marketing Specialist, Becker

These rigorous requirements reflect the CPA’s comprehensive expertise, which goes beyond the tax-focused scope of EAs.

CPA Job Responsibilities and Career Options

CPAs play vital roles across various financial fields. Their responsibilities include preparing and auditing financial statements, offering attestation services, managing budgets, evaluating investments, conducting business valuations, assessing financial risks, performing forensic accounting, and advising on corporate governance and strategic planning.

"A CPA's expertise mainly lies in accounting and auditing." - Stephanie Ng, CPA

The average salary for a CPA is around $82,000, but those who move into executive roles like Chief Financial Officer (CFO) or Controller often earn significantly more.

Career opportunities for CPAs span public accounting firms, corporate finance departments, forensic accounting, business consulting, independent practices, and even government or nonprofit roles. The CPA credential is often a must-have for high-level financial positions , which often requires a professional resume to secure that involve signing audited financial statements or working with regulatory agencies - responsibilities that go beyond the scope of tax-focused professionals.

EA vs CPA: Main Differences

Licensing and Practice Rights

The key distinction between Enrolled Agents (EAs) and Certified Public Accountants (CPAs) lies in how they're regulated and where they can practice. EAs are federally licensed by the U.S. Department of the Treasury and the IRS, which grants them the ability to work in any of the 50 states without restriction. On the other hand, CPAs are licensed at the state level, meaning their practice is generally confined to the state where they obtained their license. However, many states have "mobility" agreements, allowing CPAs to perform limited work across state lines.

Their roles also diverge in terms of services offered. EAs are specialists in tax-related matters, focusing on areas like tax preparation, planning, resolution, and representing clients before the IRS. In contrast, CPAs provide a broader range of services, including audits, attestation, financial reporting, and business consulting. Only CPAs are authorized to sign audit reports and issue audited financial statements - a critical function for publicly traded companies and businesses that require certified financials for shareholders or SEC compliance.

"EAs are the only tax professionals who do not require a state license. However, they have a federal license and can represent a taxpayer in any state." - Investopedia

This distinction is further highlighted by the differences in educational and exam requirements.

Education and Exam Requirements

The journey to becoming an EA is much quicker and less intensive than the path to becoming a CPA. EAs don't need a degree but must pass a three-part tax exam that focuses exclusively on federal tax law. In contrast, CPAs are required to complete 150 credit hours of education, pass a rigorous four-part exam covering auditing, financial accounting, regulation, and business concepts, and gain one to two years of supervised work experience.

"CPA licensure generally has a much higher barrier of entry than the enrolled agent credential." - Stephanie Ng, CPA and Author

Continuing education also differs. EAs must complete 72 hours of continuing education every three years, while CPAs typically need about 40 hours annually, though the exact requirements vary by state.

Career Paths and Salary Expectations

The career opportunities for EAs and CPAs vary widely. EAs specialize in tax services, often working in tax preparation, tax resolution (handling IRS audits, collections, and appeals), and bookkeeping. Many EAs operate independently, either starting their own practices or working remotely with flexible arrangements. Their workload tends to peak during tax season, and some focus on niche areas like international taxation or small business returns.

CPAs, on the other hand, have a much broader range of career paths. They can work in public accounting firms, corporate finance, forensic accounting, business valuation, strategic management consulting, or even take on executive roles like CFO or Controller. Unlike EAs, CPAs often work year-round, with responsibilities that extend well beyond tax-related tasks.

"Variety and scope are the name of the game for CPAs. Depending on your role, tax may only be one part of what you do." - Shannon Cantor, Content Marketing Specialist, Becker

When it comes to earnings, CPAs generally have an edge. According to Glassdoor, CPAs earn between $60,874 and $150,612, with those in executive roles like CFO earning significantly more. EAs, by comparison, earn between $68,000 and $125,000. The salary gap reflects the CPA's broader skill set, more extensive education requirements, and consistent demand across various industries.

These differences can help you determine which credential aligns better with your career aspirations and professional goals.

Which Certification Should You Choose?

Reasons to Choose EA

If you're looking for a fast track into a professional tax career, the EA (Enrolled Agent) designation is your best bet. You don’t need a college degree or prior work experience to qualify for the exam. All you have to do is pass the three-part Special Enrollment Examination, which focuses entirely on federal tax law. Most candidates can prepare in about 150 to 200 hours of study, and the total cost - including exam fees - typically stays under $1,000. This makes it one of the most accessible certifications in the finance world.

"The EA designation is the best option for tax professionals focused on tax prep, planning and IRS representation." - NATP Staff

The EA credential is ideal if your career goals revolve around tax preparation, IRS representation, and tax resolution. It allows you to practice nationwide without needing additional state licenses, which is especially useful if you're planning to work remotely or serve clients across multiple states. EAs earn between $37,690 and $107,660 annually, with top earners reaching up to $121,000.

Reasons to Choose CPA

The CPA (Certified Public Accountant) designation is often referred to as the "gold standard" in accounting, offering career opportunities that go far beyond tax work. If you're aiming for executive-level roles like CFO or Controller, the CPA is your ticket. However, the path to becoming a CPA is more demanding. You’ll need a bachelor’s degree, 150 credit hours of education, and one to two years of supervised work experience. On top of that, you’ll have to pass a challenging four-part exam that covers auditing, financial accounting, regulation, and business concepts. Be prepared to invest 320–420 study hours and spend between $3,000 and $5,000 in total costs.

"CPAs tend to secure much higher salaries due to their broader expertise." - Bryce Welker, CPA and Founder of Crush The CPA Exam

CPAs offer a wide array of services beyond taxes, including audits, financial reporting, business valuation, forensic accounting, and strategic consulting. The average CPA salary is around $92,000, with a range from $50,440 to $137,280. Additionally, CPAs typically charge 20–40% higher billing rates than EAs, ranging from $150 to $500 per hour.

No matter which certification you pursue, the key to success lies in leveraging your new credentials effectively during your job search.

Using Job Search Platforms After Certification

Earning your certification is just the first step. Standing out in the crowded job market requires more than qualifications - it demands a strategic approach. To land competitive roles, especially with top firms or in corporate finance, you’ll need an ATS-optimized resume. Applicant tracking systems (ATS) are often used by employers to filter resumes, and failing to optimize yours could mean your application never gets seen. Traditional platforms like Indeed or LinkedIn can feel like a black hole for job applications, especially for roles at prestigious firms.

Scale.jobs offers an alternative solution, combining human expertise with AI tools tailored for certified professionals. Unlike automated bots that can get flagged by ATS systems, Scale.jobs uses trained virtual assistants to manually complete job applications. These assistants customize your resume and cover letter for each job, ensuring they align with the specific requirements of the posting. They handle submissions across various platforms, from corporate ATS portals to niche accounting job boards.

Here’s what you get:

- Real-time updates via WhatsApp

- Time-stamped proof-of-work screenshots for every submission

- A 24-hour turnaround for tailored applications

The platform offers three pricing tiers:

- A free plan with job tracking tools and an ATS-compliant resume builder

- An AI Assistant Pro plan for $9/month, which includes unlimited AI-generated resumes and cover letters

- Human Assistant packages starting at $199 for 250 applications, with flat-fee pricing and no recurring subscriptions

For newly certified EAs and CPAs, this service can save over 20 hours per week, letting you focus on networking, interview prep, or pursuing additional certifications. It’s especially helpful for professionals dealing with visa requirements (H1B, F1, CPT, TN, O1), where securing a job quickly is crucial to maintaining legal status.

Enrolled Agent VS CPA in 2025

Conclusion

Deciding between becoming an EA or a CPA largely depends on your career aspirations. If your passion lies in tax law - helping clients navigate IRS audits, collections, and appeals - the EA credential offers a straightforward path. With no degree requirement and an exam that typically takes 150 to 200 hours of study, you can achieve a federal credential recognized nationwide. While salaries for EAs vary, seasoned professionals can command much higher earnings.

In contrast, the CPA designation opens doors to a wider range of opportunities, such as auditing financial statements, offering strategic business advice, or climbing the corporate ladder to executive roles like CFO or Controller. The CPA journey requires more time and financial investment but leads to broader career prospects. On average, CPAs earn around $92,000 annually, with the most experienced professionals earning over $150,000.

Both EAs and CPAs have unlimited representation rights before the IRS, but only CPAs can perform audits and certify financial statements. Interestingly, many professionals choose to pursue both credentials since the EA exam overlaps significantly with the CPA’s Regulation (REG) section, making the EA a practical first step for aspiring CPAs.

Once you've earned your credentials, how you market yourself becomes crucial. Using tools like scale.jobs can help you stand out in today’s competitive job market. Their platform offers ATS-friendly resume tools, AI-powered applications, and personalized support to ensure your qualifications get noticed by employers.

FAQs

What are the main career benefits of becoming an EA instead of a CPA?

The decision to pursue a career as an Enrolled Agent (EA) versus a Certified Public Accountant (CPA) largely depends on your professional aspirations and areas of interest. EAs are federally licensed tax professionals, giving them the authority to represent clients in all 50 states before the IRS. This nationwide recognition makes the EA credential a strong fit for those looking to focus on tax preparation, tax planning, and IRS representation without being tied to state-specific regulations.

In contrast, CPAs have a broader skill set that includes accounting, auditing, and financial management. However, CPA licenses are issued on a state-by-state basis, which can limit their scope geographically. If your career goals center exclusively on tax-related services, the EA designation provides a more direct route, with fewer educational and licensing hurdles compared to becoming a CPA.

What are the main differences between the EA and CPA exam processes?

The CPA exam is a rigorous, four-part test that dives into auditing, financial accounting, regulation, and business concepts. To sit for this exam, candidates must complete 150 credit hours of education. With a pass rate hovering between 45–55%, it’s known for being quite demanding.

On the other hand, the EA exam is a more focused, three-part test that centers exclusively on federal tax law. It comes with fewer educational requirements and generally sees higher pass rates, making it a less daunting option.

For those aiming to specialize in tax-related careers, the EA exam provides a quicker and more direct route. Meanwhile, the CPA exam is better suited for individuals looking to explore a wider range of opportunities in accounting and auditing.

Can an Enrolled Agent (EA) handle financial audits like a Certified Public Accountant (CPA)?

No, Enrolled Agents (EAs) are experts specifically in tax-related matters. Their skills revolve around preparing tax returns, offering tax advice, and representing clients before the IRS. Unlike Certified Public Accountants (CPAs), EAs are not authorized to conduct financial audits, review or prepare financial statements, or provide assurance services.

If you're exploring career options or deciding which professional to hire, keep in mind that CPAs have a wider range of qualifications that include accounting, auditing, and financial reporting. On the other hand, EAs are focused solely on tax-related services.