CFP Certification ROI: Is It Worth It?

Compare the costs, study time, and career benefits of CFP certification to decide if the credential delivers long-term ROI for financial planners.

The CFP certification can boost your career in financial planning, but it comes with high costs and time commitments. Whether it’s worth pursuing depends on your goals, current skills, and the market you work in. Here’s a quick breakdown:

- Costs: Education and exam fees add up, but skipping it saves money.

- Time: Requires significant study time versus focusing on hands-on experience.

- Career Impact: CFP holders often access better roles and pay, but success is possible without it in other finance areas.

- Long-Term ROI: Credential can pay off over time, but depends on how you leverage it.

Bottom Line: If you aim for leadership or client-focused roles, the CFP is a strong choice. If not, gaining experience and other skills might serve you better.

1. CFP Certification

Cost and Time Investment

Pursuing the CFP certification requires a notable commitment of both time and money. The exact costs can vary depending on your educational background and the study methods you choose. On top of the financial investment, candidates often juggle their preparation with full-time jobs and personal responsibilities, making time management a critical factor.

Earnings and Career Outcomes

The CFP certification is widely regarded as a credential that can boost career opportunities and potentially lead to higher earnings. It serves as a marker of expertise, often opening doors to positions in firms that value strong financial planning skills. That said, the extent of its impact on earnings depends on factors like market conditions and an individual’s qualifications. These aspects are explored further in the analysis of long-term return on investment.

Long-Term ROI

Supporters of the CFP certification believe the upfront investment can yield benefits over time. It’s seen as a way to enhance professional credibility and unlock career advancement opportunities. The credential may help professionals access specialized roles and more competitive compensation structures. However, the actual return on investment depends on a combination of personal career choices, market trends, and individual performance. In the next section, we’ll compare these outcomes with career paths that don’t require the CFP certification.

2. No CFP Certification

Cost and Time Investment

Choosing to skip CFP certification can save you a significant amount of money and time. Without the expense of exam fees and coursework, or the hours spent studying, you can focus on gaining practical experience, expanding your professional network, or pursuing other credentials. This path also lets you start earning sooner, avoiding the financial strain of upfront costs and allowing for an earlier entry into the workforce.

Earnings and Career Outcomes

Saving time and money is great, but your career success depends on more than just certifications. Many finance roles, such as those in banking, investment management, or insurance, don’t require a CFP certification. Employers in these areas often value hands-on experience, practical skills, and strong networking over formal credentials. While having a CFP can open doors in certain niches, it’s entirely possible to build a thriving career by sharpening your expertise and earning other certifications that showcase your abilities.

Long-Term ROI

In the long run, career success depends on how well you use your skills and connections. Skipping the CFP certification can mean saving time and money early on, but some advanced roles may still lean toward candidates with the credential. Your long-term success will ultimately come down to how effectively you use your experience, alternative qualifications, and professional relationships to establish credibility in the competitive financial planning field. With a focus on practical knowledge and strong networks, you can build a solid reputation over time.

Is CFP Certification Worth It?

Pros and Cons

CFP Certification vs No Certification: Cost, Time, and ROI Comparison

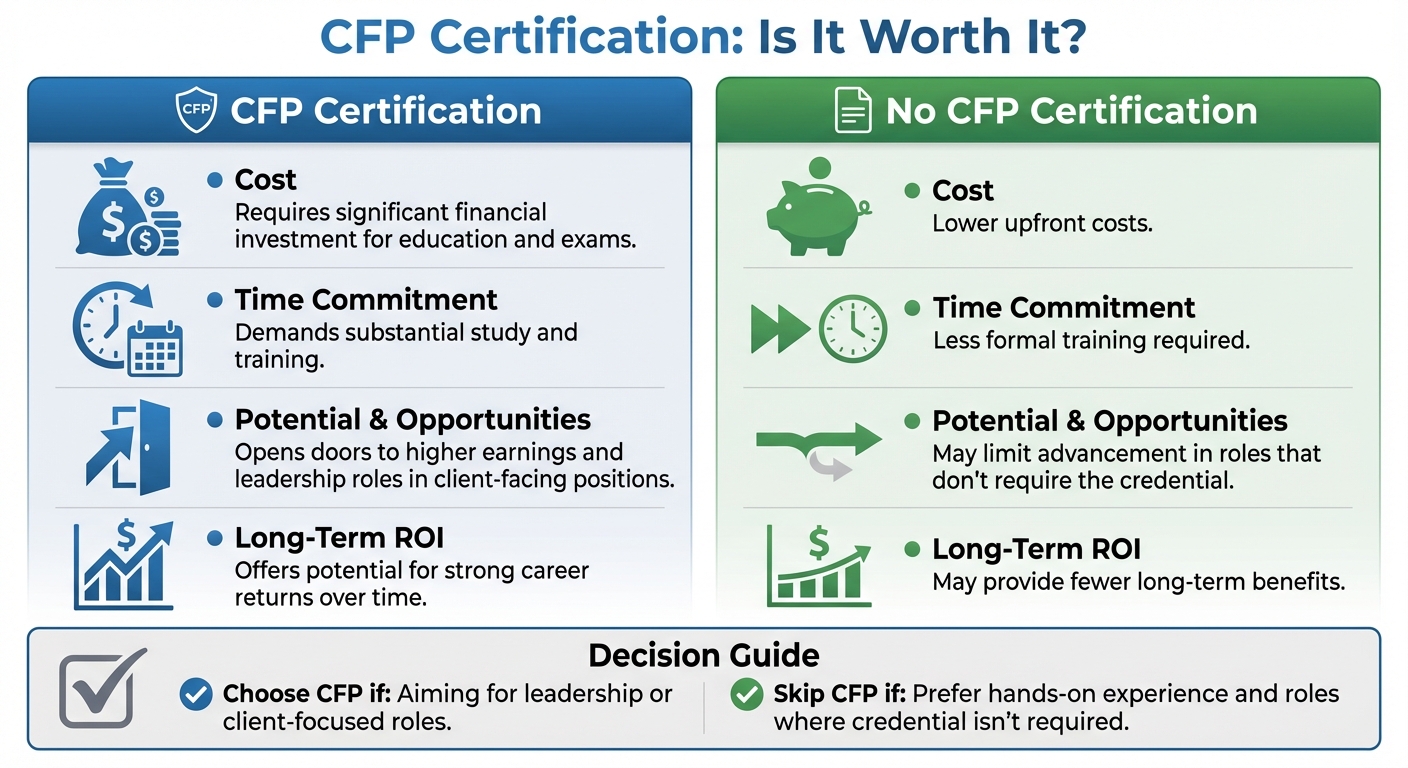

Weighing the decision to pursue a CFP certification versus skipping it involves balancing the costs, time investment, and career opportunities. Here's a quick comparison to help you decide:

| Aspect | CFP Certification | No CFP Certification |

|---|---|---|

| Cost | Requires a significant financial investment for education and exams | Lower upfront costs |

| Time Commitment | Demands a substantial amount of study and training | Less formal training required |

| Potential & Opportunities | Opens doors to higher earnings and leadership roles in client-facing positions | May limit advancement in roles that don’t require the credential |

| Long-Term ROI | Offers the potential for strong career returns over time | May provide fewer long-term benefits |

Earning a CFP certification can pave the way for advanced advisory roles and higher earning potential, making it a solid choice for those aiming for leadership or client-focused positions. On the other hand, skipping the certification might be a better fit if you want to avoid upfront costs and dive straight into gaining hands-on experience, especially in roles where the credential isn’t a key requirement.

Ultimately, the right path depends on your career goals, financial situation, and how much time you're ready to invest in professional development.

Conclusion

When weighing the pros and cons of pursuing CFP certification, think about how it fits with your career aspirations, financial resources, and willingness to dedicate the necessary time and money. If you're looking to establish yourself in financial planning, earning this certification can highlight your dedication to the field. Take into account your budget and how much time you can realistically commit. Ultimately, your choice should align with your personal and professional goals.

FAQs

How can you determine if earning the CFP certification is worth the investment?

Deciding if the CFP certification is worth pursuing comes down to a few important considerations. First, think about your career goals - does earning the Certified Financial Planner designation align with where you see yourself in the future? This certification can open doors, but it needs to match your aspirations to truly pay off.

Next, take a close look at the costs, which typically range from $479 to $699 or more. Compare this investment to the potential return on investment (ROI). Benefits like higher earning potential, quicker job placement, and expanded career opportunities could make the expense worthwhile.

You should also factor in the credibility and expertise that the CFP certification brings. It’s a credential that can enhance your professional reputation and build trust with clients, which is especially valuable in finance-related roles. For many, this added credibility and the career boost it provides make the certification a smart move.

What are the long-term career benefits and earning potential of CFP certification?

Earning a CFP certification can take your career to the next level by strengthening your professional reputation and unlocking advanced opportunities in financial planning. It establishes trust with clients, helps you reach a wider audience, and even allows you to justify charging higher fees for your expertise.

In the long run, these benefits often lead to increased earning potential and greater job security, making the effort and investment in CFP certification a smart move for anyone dedicated to succeeding in the financial planning field.

Is a CFP certification necessary to succeed in financial planning?

While you can pursue a career in financial planning without a CFP certification, skipping it might hold you back in terms of career growth, credibility, and earning potential. Many top-tier roles and firms favor professionals with certifications, and clients often feel more confident working with advisors who hold respected credentials like the CFP.

This certification showcases your expertise in financial planning, helping you attract clients and differentiate yourself in a crowded field. If you're committed to building a successful, long-term career in financial planning, earning a CFP certification could be a smart investment in your future.